us japan tax treaty article 17

3 Relief From Double Taxation. Tax treaty network.

Us Ch Pension Plans And Treaty Benefits Kpmg Global

Article IV of the Protocol replaces Article 11 of the existing Convention.

. TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. Us japan tax treaty article 17 Tuesday February 22 2022 Edit. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty were exchanged and entered into force on 30 August 2019.

The List of Japans Tax Conventions. Subject to the provisions of Articles 15 17 and 18 salaries. Tax Information Exchange Agreements principally for the exchange of informationregarding tax matters 3.

8 Exchange of Information. Article 14 INCOME FROM EMPLOYMENT 1. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7 months from the signature to the enactment.

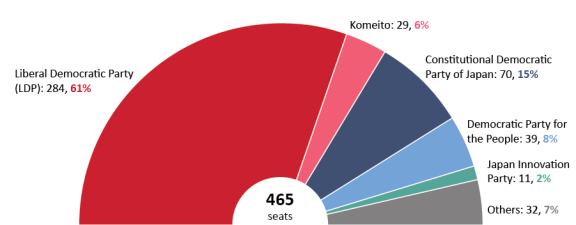

As of 1 January 2021 Japan has entered into 78 tax treaties with 142 countries andor regions. Your privacy is important for us and we will keep your information secure. Contracting State mean Japan or the United States as the context requires.

Article 17 Pensions Social Security Annuities Alimony and Child Support paragraph 1 of Article 18 Pension Schemes and Articles 24 Relief From Double Taxation 25 Non-discrimination and 26 Mutual Agreement Procedure of this. Security taxes to both the united states and japan for the same work. If however the resident of Japan is also a.

Article 17 of the US-Japan Tax Treaty clearly states. Lets take a look at how the US and Japan tax treaty impacts pension. Japan is also one of the United States longest-standing tax treaty partners.

Japan has long been one of the United States largest trading partners. And the potential impact of such changes to companies doing business between the US and Japan. Paragraph 1 of new Article 11 generally grants to the residence State the exclusive right to tax interest beneficially owned by its residents and arising in the other.

Tax Conventions principally for the elimination of double taxation and the prevention of tax evasion and avoidance 2. Non-resident taxpayers are not entitled to take foreign tax credits on their Japan income tax returns unless one has a PE. For example in order to apply reduction of Japanese withholding tax rate under the tax treaty 20 10 Japan-China Tax Agreement Article 10 Paragraph 2 on dividends paid to Chinese shareholders from the Japanese corporation the shareholders are supposed to file Application Form for Income Tax Convention to the Japanese tax office ministerial.

Article 11 sets forth rules for taxation of cross-border interest payments. Paragraph 1 of New Article 11. Adopted by the OECD Committee on Fiscal Affairs on 26 June 2014.

Article 17 is not excluded from the saving clause other than paragraph 3 which is not applicable to Denises pension. This Convention shall apply only to persons who are residents of one or both of the. View our privacy policy.

Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. 4 Income From Real Property. As of June 3 2022.

Background the long road to ratification A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of. Income derived by a resident of a. F the term company means any body corporate or any entity that is.

Amended Japan-US Tax Treaty. The proposed new treaty will make an overall revision of the treaty between the two countries which was put in place in 1971. D the term tax means Japanese tax or United States tax as the context requires.

D the term tax means Japanese tax or United States tax as the context requires. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in. E the term person includes an individual a company and any other body of persons.

9 Golding Golding. E the term person includes an individual a company and any other body of persons. The provision included in the 2006 US Model Treaty reads as follows.

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March 81971. 2 Saving Clause and Exceptions. Saving Clause a Except to the extent provided in paragraph 5 this Convention shall not affect the taxation by a Contracting State of its residents.

Australia - Japan Tax Treaty. The Government of Japan and the Government of the United States of America Desiring to conclude a new Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income Have agreed as follows. The treaty entered into force on 17 October 2020 and will apply with respect to taxes levied on the basis of a taxable year for taxes for any taxable years beginning on or after 1 January 2021 and with.

1 US-Japan Tax Treaty Explained. ISSUES RELATED TO ARTICLE 17 OF THE MODEL TAX CONVENTION.

France Denmark Double Tax Treaty Finally Signed By Both Countries

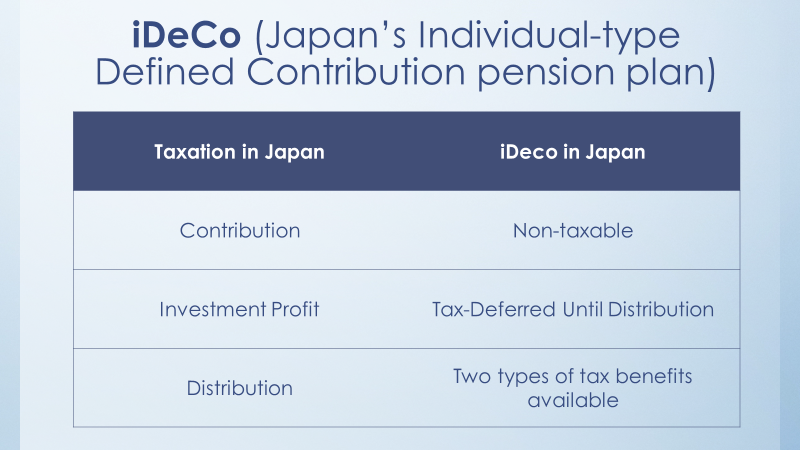

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

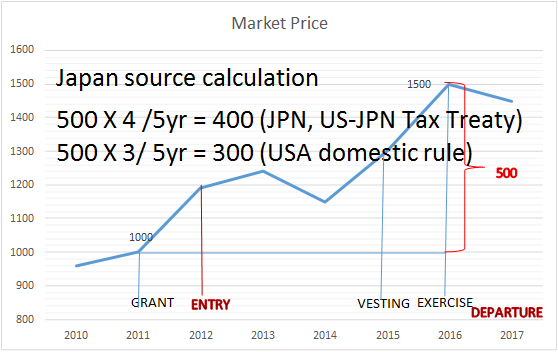

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Form 8833 Tax Treaties Understanding Your Us Tax Return

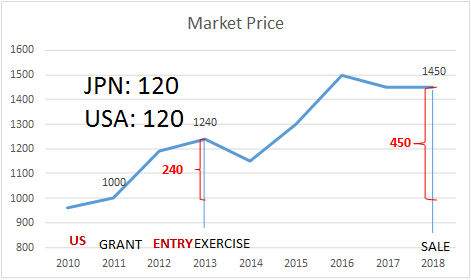

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

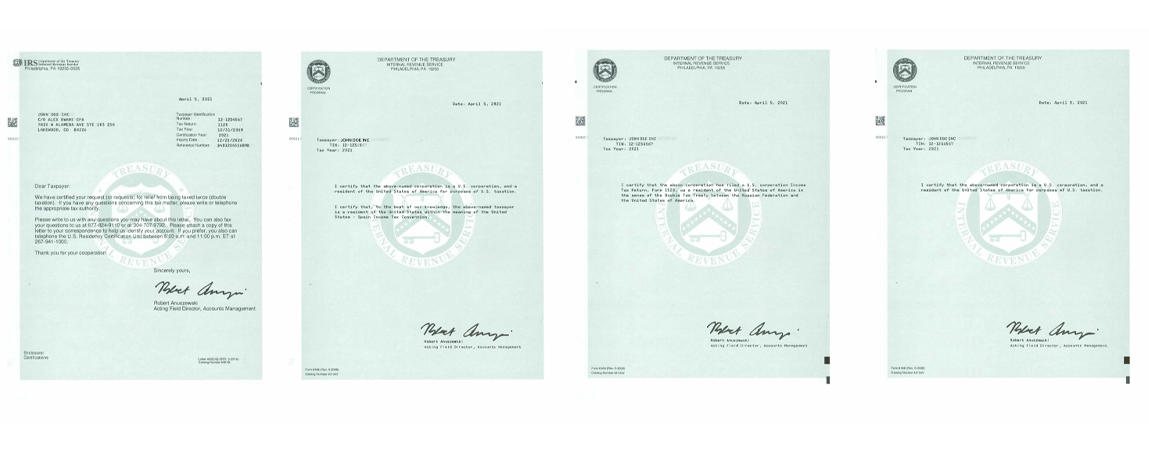

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Japan United States International Income Tax Treaty Explained

Japan United States International Income Tax Treaty Explained

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Japan U S Relations Issues For Congress Everycrsreport Com

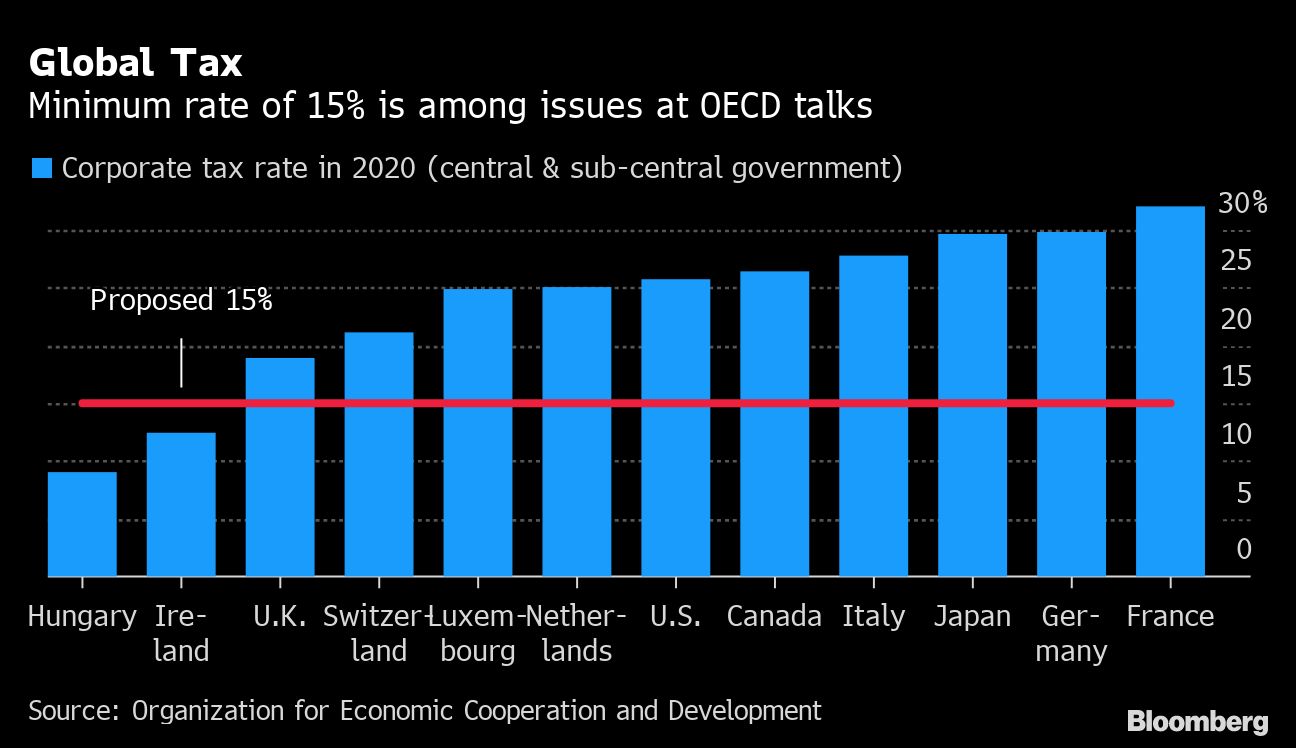

Global Minimum Tax May Not Make It Past The U S Congress Treasury Risk